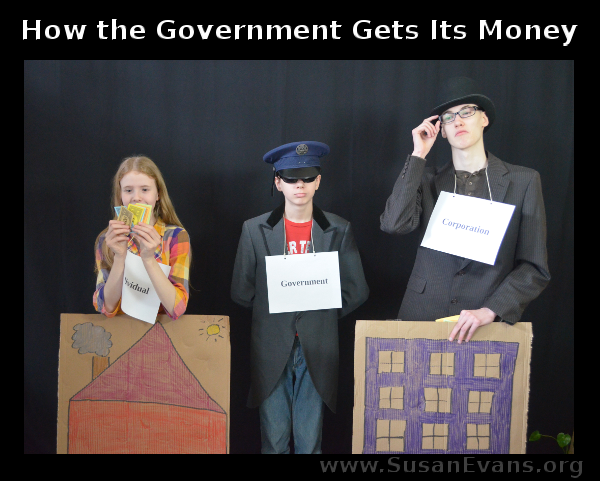

The U.S. government at the federal, state, and local levels has to get its money from somewhere. So it taxes individuals, businesses, and corporations to get the money it wants for its countless programs. Today we will show you through a series of skits how this is done.

The Notgrass Company has sponsored these fun blog posts because we are basing this series on their Exploring Government book. One of the chapters requires students to understand the ways that citizens are taxed. We continue our series of high school government with another set of skits for your enjoyment.

How the Government Gets Its Money

Federal Taxes:

The income tax is the main source of federal revenue, providing over half of federal money. This is a progressive tax, which means higher incomes are taxed more.

The next biggest source of revenue for the federal government is the payroll tax, which provides about one-third of federal money. This tax helps pay for Social Security and Medicare.

Other taxes include an excise tax of things like tobacco, alcohol, jewelry, and guns, customs of tariff duties on some imported goods, estate taxes when an heir’s inheritance exceeds $2 million, and much more.

State Taxes:

States also have an income tax. Some states don’t tax personal income, and so have to rely more on other taxes. Usually, income tax rates are form 2 to 6 percent.

Another major state tax is the sales tax. Most states impose a flat statewide rate and let counties and cities add an additional tax on sales within their borders.

States also get a lot of revenue from automobile-related taxes. In about half of the states, there is an Ad valorem (to the value) tax for registering a vehicle. There are also taxes of alcohol, tobacco, utilities, theme parks, and hotels/motels.

Local Taxes:

Cities and counties impose property tax on the assessed value of the real property in them. Homeowners and business owners both pay property tax. There is also a business tax, which is a small percentage of the total sales a business has in a year. Counties also charge for a business license.

I hope you enjoyed our re-enactment of “How Government Gets Its Money.” We made quite a few props for these skits, and we had a blast behind the scenes!

We truly enjoyed producing this series of high school government posts, breaking down concepts from the Exploring Government book, and making them come to life! If you would like to buy the book, get it from the Notgrass website to bless their family the most!

Tags: Exploring Government, government, hands-on learning, high school, Notgrass

You always have such fun ideas 🙂

Thank you, but most of these ideas came from my children!

This has been a great series! We have enjoyed watching each one of these videos. It has made an easy way for introduce these terms to my 5th grader.

Glad you enjoyed the series! We learned a lot while performing all these skits.

Fun Idea! I can’t wait to do more things like this as my kids get older! Thanks for sharing!

Skits are a great way to internalize learning. We had a great time!

I love this – any type of hands on learning helps the students to retain the info!! So much fun too!!!

Hands-on helps my kids to remember the ideas they are studying.

The video was too cute! I have never felt so entertained when it comes to taxes lol! But it does make me cringe at how much money we give the government… I guess it’s necessary, though, to enjoy the benefits that we do:)

Glad you liked the video. My kids are goofy and fun to watch.

What a great way to help remember how the tax system works!

Thanks! My kids had fun trying to figure out how to illustrate the concepts.

I love your teaching videos! I’m learning too by all the wealth of knowledge you share!

We tried to simplify basic facts about government. It helps that my kids are goofy!